Rating Process and Methodology

- RATING REQUEST

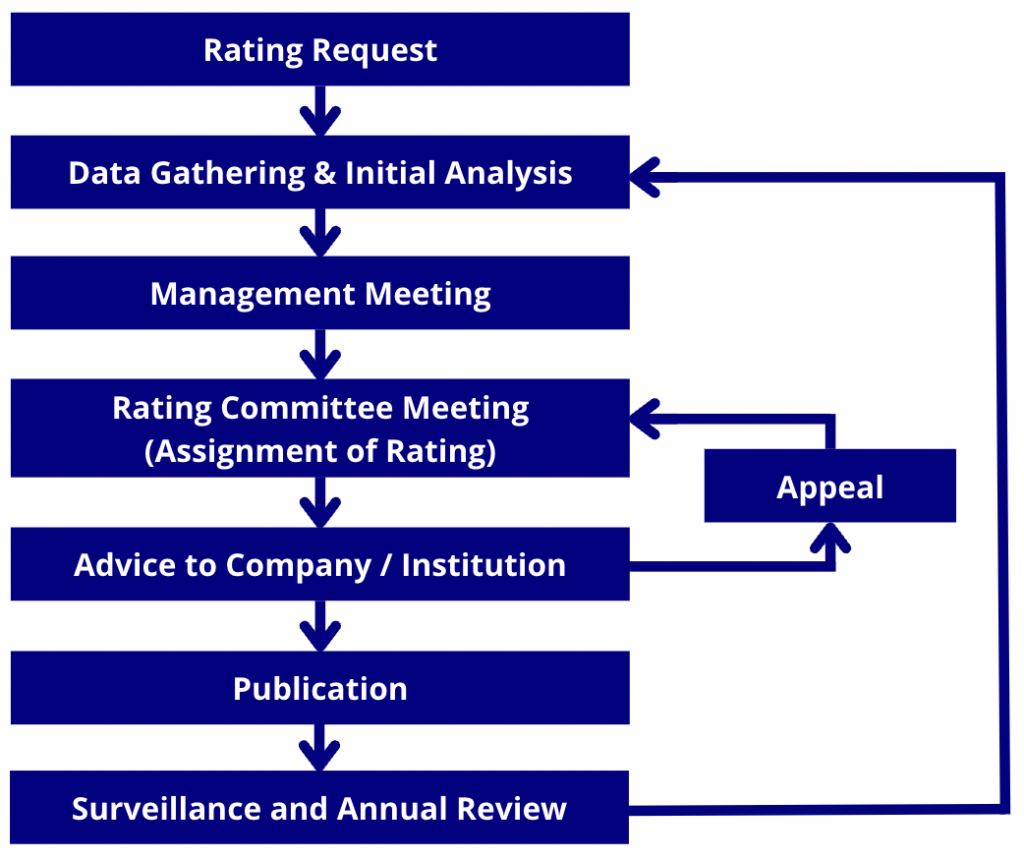

The rating process begins when a prospective ratee, or its underwriter, requests for a company rating and/or a rating for a proposed debt issue or transaction.

- DATA GATHERING & INITIAL ANALYSIS

A team of analysts is assigned to the particular rating task and comes up with a list of information requirements for the ratee. The team reviews the financial and non-financial information received from the ratee and from other sources. All privileged information is kept strictly confidential by the analysts/Rating Committee. Even the fact that a company or issuance is undergoing the rating process is not shared with any other party outside of PhilRatings.

- MANAGEMENT MEETING

The team of analysts meets with the ratee’s senior management to discuss business and competitive strategies, operating practices, financial position and other factors that could affect credit quality.

- RATING COMMITTEE MEETING

After meeting with the ratee’s management, members of the analytical team present their findings to the Rating Committee. All relevant factors concerning the rating are explored in an open and candid discussion that results in a rating decision. The assigned credit rating is arrived at by votation by the Rating Committee members.

- ADVICE TO COMPANY / INSTITUTION

Once the Rating Committee assigns a rating, the decision is communicated to the ratee, together with the reasons for the rating.

APPEAL

In the event that the ratee disagrees with the rating, it has the opportunity to appeal the decision or the right to keep the rating confidential. The ratee appealing a rating decision must provide new information which is material to the appeal and which specifically addresses the concerns expressed by the Rating Committee. There is no guarantee, however, that additional information will alter the Rating Committee’s initial rating decision.

- PUBLICATION

Once the ratee accepts the rating, it is disseminated to the market and to PhilRatings’ subscriber base, as well as to local and foreign business news media outlets.

- SURVEILLANCE AND ANNUAL REVIEW

To ensure up-to-date assessments while the credit rating remains outstanding, PhilRatings monitors the on-going performance of the rated issue or issuer and the economic environment in which it operates. PhilRatings expects the ratee to provide financial and other information on a timely basis. The rating can change at any time if warranted.

But even where there is no obvious reason to change the rating, PhilRatings conducts a continuing review of any account and transaction and may meet or touch base with the ratee as needed. These review meetings and discussions focus on developments over the period since the last formal review, and on the outlook for the coming year.

General Credit Rating Methodology

BUSINESS RISK

ECONOMIC RISK

PhilRatings reviews the risks arising from the over-all economy in which the company operates and gauges how the dynamics of the economy affect the operations of the particular company. Accordingly, the economy’s strength, diversity, and volatility, as well as the government’s ability to manage the economy through boom and recessionary periods, are evaluated. The analysis particularly focuses on the size, structure and growth prospects of the economy, the extent to which it is open to external markets, and potential vulnerabilities.

INDUSTRY RISK

Industry risk covers many elements, and for any industry, there will be both positive and negative factors. While it is difficult to say which factors will prevail, PhilRatings gauges the dynamics of the industry and the extent to which those dynamics lead to more or less risk from the investor’s point of view. Accordingly, the analysis covers the structure of the industry, the dynamics of competition, the regulatory and legislative framework, and the government’s philosophy with respect to the industry – i.e., market-oriented or interventionist.

MARKET POSITION

Market position analysis involves an assessment of the benefits or weaknesses stemming from a company’s market position (e.g., pricing power, quality of business, etc.). This involves an evaluation of the company’s market share in key business lines, and the real advantages stemming from that market position, together with a review of the extent of competition in, and vulnerability of, the market position.

BUSINESS DIVERSIFICATION

Business diversification addresses the diversity of a company’s products, business lines and customer base, and the benefits or weaknesses (such as geographic or business concentrations) that flow from them.

MANAGEMENT AND STRATEGY

Managerial effectiveness and credibility are assessed through an evaluation of the company’s past performance and of the appropriateness of management’s strategies within a changing environment. Consideration is also given to the organizational structure and the extent to which it enhances managerial efficiency, the quality and depth of both management and the planning process (both financial and strategic). The analysis normally involves a comparison of past performance to budget or plan.

FINANCIAL RISK

EARNINGS GENERATION

Key considerations are earnings levels, trends, and stability, as well as the fundamental, core, long-term earnings power of the company. The analysis covers operating margins, diversity and sustainability of income sources, cost structure, and the earnings outlook. The company’s ability to cover interest and other fixed charges is also considered.

CASH FLOW AND LIQUIDITY

Cash flow and liquidity analysis involves an evaluation of the company’s sources of funds and its adequacy to meet debt service requirements. In assessing cash flow adequacy, the company’s future funding needs, such as for expansion of production facilities and acquisition, are also considered.

CAPITAL STRUCTURE / LEVERAGE

Key considerations are the debt and equity mix, as well as the maturity profile of existing indebtedness. The types of equity capital utilized are assessed, such as preferred shares that may be redeemable and thus may constitute a future need for refinancing, and appraisal increment in property which may be dissipated if asset values decline. In assessing leverage, off-balance sheet items are also considered, such as operating leases, guarantees to other companies, and contingent liabilities.

FINANCIAL FLEXIBILITY

Financial flexibility is a summation of all the preceding factors, since it is an evaluation of a company’s ability to meet unexpected demands on funds. Factors considered include:

- the company’s ability to access various funding markets and raise capital from the public or private sources, generally, and in a difficult environment

- the extent of internal reserves available to cover unexpected losses

- the franchise value of specific businesses

- assets where the market value is significantly greater then the book value

- ability to sell; and

- the likelihood of support from private stockholders or the government

ASSET QUALITY

Credit risk across the entire spectrum of the institution’s activities is evaluated (including receivables, marketable securities, equity investments, on- and off-balance sheet counterparty exposures, etc.) This involves an analysis of the structure of the balance sheet and the maturity profile of the asset portfolio. Concentrations of credit and investment risk also are considered, along with problem loans and provisioning policy.